We Have a Bright Future if We Take the Right Steps Today

By BILL RANEY, president

West Virginia Coal Association

CHARLESTON – The membership of the West Virginia Coal Association today announced it is endorsing Donald Trump, Republican of New York, for the office of president of the United States in this year’s election. The unanimous decision was made at a membership meeting in Charleston earlier today.

CHARLESTON – The membership of the West Virginia Coal Association today announced it is endorsing Donald Trump, Republican of New York, for the office of president of the United States in this year’s election. The unanimous decision was made at a membership meeting in Charleston earlier today.

“Donald Trump has been firm and clear throughout his campaign in his commitment to rebuild America’s basic industries – the industries that made this country great – such as coal, steel and manufacturing” said Bill Raney, WVCA president, in announcing the endorsement. “Trump has said he will reverse the Democratic regulatory assault that has cost the coal industry more than 40 percent of our production and jobs since 2008.”

“In contrast, Hillary Clinton’s proposals essentially double-down on the job killing Obama policies,” Raney continued. “West Virginia can’t afford that and neither can the nation.”

“We believe that with the leadership team of Donald Trump in the White House and Bill Cole as Governor, West Virginia will begin to rebuild what we have lost to the Obama War on Coal and also look to the future once again with confidence.”

Bill Raney is president of the West Virginia Coal Association, a trade association in Charleston, West Virginia, representing approximately 95 percent of the state’s coal production.

By Alex Wiederspiel in News | April 05, 2016 at 6:43PM

CLARKSBURG,  W.Va. — Chris Hamilton, the Vice President of the West Virginia Coal Association, does not think Senator Joe Manchin should need any additional input on the nomination of Merrick Garland to the U.S. Supreme Court.

W.Va. — Chris Hamilton, the Vice President of the West Virginia Coal Association, does not think Senator Joe Manchin should need any additional input on the nomination of Merrick Garland to the U.S. Supreme Court.

“Justice Garland is a sitting judge on the D.C. Circuit, and he’s had a number of EPA cases before him,” Hamilton said Tuesday on the MetroNews-affiliated “The Mike Queen Show” on the AJR News Network. “And he has, almost without exception, upheld the agency’s rules, rule making, and requirements that it has proposed and implemented.”

The WV Coal Association sent an open letter to Senator Manchin expressing their disapproval of the nominee.

“We’d like to see Senator Manchin join with the core of U.S. senators who have vowed not to seat Justice Garland,” he said.

Garland has been at the center of a largely partisan fight between Democrats and Republicans in Washington D.C. over whether or not the Senate would hold any confirmation hearings–or even meet with Garland–following his nomination to fill the vacancy on the U.S. Supreme Court in the wake of Justice Antonin Scalia’s death.

Hamilton said his association wouldn’t support a nomination that supported the Clean Power Plan, which is facing myriad legal challenges.

“That’s what prompted the letter to Senator Manchin,” he said. “Just remind him of the fact that this Clean Power Plan remains as this President’s center piece of his Administration.”

Hamilton was quick to blame the EPA and the Obama Administration for the losses suffered by the coal industry.

“That program has resulted in the complete decimation of the state’s coal industry, shutting down record number of mines, laying off of thousands and thousands of miners practically just destroying our state’s economy,” he said.

Senator Manchin reportedly met with Garland on Tuesday.

Since President Obama announced Garland as the nominee, Manchin held a town hall in Charleston to discuss it with constituents.

He also vowed not to support the nomination if Garland was “adamantly entrenched” against the fossil fuel industry.

| Coal Commodity Region/Fuel | Avg. BTU | SO2 | Price | Price/mmBTU |

| Central Appalachia | 12,500 | 1.2 | $ 42.25 | $ 1.69 |

| Northern Appalachia | 13,000 | 3 | $ 48.60 | $ 1.87 |

| Illinois Basin | 11,800 | 5 | $ 32.20 | $ 1.36 |

| Powder River Basin | 8,800 | 0.8 | $ 9.45 | $ 0.54 |

| Uinta Basin | 11,700 | 0.8 | $ 38.05 | $ 1.63 |

| Natural Gas (Henry Hub) |

n/a |

0.01 |

n/a |

$ 1.79 |

By T.L. HEADLEY, MBA, MA

CHARLESTON – According to the latest reports from the Energy Information Agency (EIA), coal production in the U.S. continues to slide, finishing the week off by 38 percent from 2015 totals. Meanwhile spot prices for coal continue to hold steady as they have for the past month. Natural gas spot prices, however, continue to slide.

According to the EIA’s April 1, 2016 weekly report, U.S. coal production for the week totaled just 11.60 million tons, down from 18.84 million tons for the same week in 2015. Year to date production totaled just 157.27 million tons, down from 227.45 million tons (down 30.9 percent). And for the previous 52 weeks, production was off by 17.4 percent, down from 819.97 million tons from 992.90 million tons in 2015.

The decline in coal production was reflected in rail car loadings, which were off 37.8 percent from for the week to just 66,281. This decline in rail traffic is almost entirely due to the decline in coal production and has resulted in both major eastern rail systems announcing major restructurings. CSX recently announced it is closing its regional headquarters in Huntington, West Virginia. Norfolk Southern likewise announced it is closing the Bluefield, West Virginia offices.

Coal exports for the month of January (the most recent data available) were sharply below last year. Metallurgical coal exports are off by 38.5 percent from January 2015 and steam coal exports are off by 54 percent. Imports of coal into the U.S were down for the month by 46.4 percent.

Electric output was down 4.6 percent compared to the same week last year, with 67,690 MWH of electricity produced compared to 70,933 MWH produced for the same period last year.

Domestic steel output was up was up from the previous week.

According to numbers from the American Iron and Steel Institute, in the week ending March 26, 2016, domestic raw steel production was 1.68 million net tons while the capability utilization rate was 71.6 percent. Production was 1.60 million net tons in the week ending March 26, 2015 while the capability utilization then was 67.7 percent. The current week production represents a 4.6 percent increase from the same period in the previous year. Production for the week ending March 26, 2016 is up 0.4 percent from the previous week ending March 19, 2016 when production was 1.69 million net tons and the rate of capability utilization was 71.3 percent.

Adjusted year-to-date domestic raw steel production through March 26, 2016 was 21.5 million net tons, at a capability utilization rate of 70.3 percent. That is down 3.4 percent from the 22.3 million net tons during the same period last year, when the capability utilization rate was 72.1 percent.

In terms of regional coal production, all three major basins report significant decreases from 2015.

The Appalachian Basin finished the week at 2.81 million tons, down from 4.83 million tons in 2014 (-42 percent). Interior Basin production also finished the week down, at 2.19 million tons compared to 3.51 million tons last year (-38 percent). Western production finished the week at 6.60 million tons from 10.30 million tons last week (-36 percent). All three basins remain down significantly for the previous 52 weeks, with the Appalachian Basin off 23.1 percent, the Interior Basin off 17.3 percent and the Western Basin off 14.7 percent.

According to the West Virginia Office of Miners’ Health Safety and Training, coal production in the state stands at 11.66 million tons through March 24th. Of that total, 9.66 million tons was mined by underground operations and 2.01 million tons was produced by surface mining. Only 62 mines have reported production in December2015. Several large operations have idled production due to financial restructuring or in response to slack demand.

However, according to WVOMHST, coal mining employment in West Virginia has fallen sharply to just 11,907 total active miners, with 9,782 working underground and 2,125 working on surface operations. The office does not report data for contract miners or preparation plant workers on a weekly basis.

According to EIA, West Virginia coal production for the week totaled 1.23 million tons, off from 2.11 million tons for the same week in 2015 – down 42 percent.

Production was down in both the northern and southern coalfields of West Virginia compared to the same week in 2015 by 39 percent and 45 percent respectively. For the week, northern West Virginia production finished up at 628,000 tons versus 617,000 tons last week and 1.03 million tons last year. Southern West Virginia, however, finished down at 601,000 tons versus 588,000 tons last week and 1.07 million tons a year ago.

Coal production in Kentucky ended the week at 774,000 tons produced, down from the 1.31 million tons from 2015. Eastern Kentucky coal operations finished the year at 344,000 tons, down from 596,000 tons. Meanwhile, western Kentucky coal operations finished at 431,000 tons versus 710,000 tons in 2015.

Wyoming coal production finished the week at 4.92 million tons versus 7.73 million tons in 2015, off by 36 percent.

Illinois coal production finished the week at 839,000 tons versus 1.3 million tons for the same week in 2015. Indiana production, however, fell significantly, finishing at 461,000 tons versus 734,000 tons for the month a year ago. Ohio production finished the week at 205,000 tons versus 398,000 tons for the week in 2015. Pennsylvania production was down, finishing the week at 634,000 tons versus 1.1 million tons in 2014. Virginia coal production continues to tall, finishing the year down at 140,000 tons versus 286,000 tons for the year in 2015.

Coal prices on the spot market were unchanged this week. Central Appalachian coal finished the week at $42.25 per ton or $1.69 per mmBtu. Northern Appalachian coal also finished unchanged, coming in at $48.60 per ton or $1.87 per mmBtu. Illinois Basin coal held steady at $32.20 per ton or $1.36 per mmBtu, while Powder River Basin coal remained at $9.45 per ton or $0.55 per mmBtu. Uinta Basin coal prices finished unchanged at $38.05 per ton or $1.63 per mmBtu.

Natural gas prices on the Henry Hub also held steady this week to finish at $1.79 per mmBtu. Natural gas producers reported a significant decline in their stored reserves – at 2.47 trillion cubic feet, down by 25 billion cubic feet compared to the previous week, for a total of 3.48 trillion cubic feet in storage. This week’s working natural gas rotary rig count is down by 12 from last week to 464 working rigs. And the count remains down by 584 rigs from a year ago – a decline of 21%. This number includes rigs working in both oil and gas plays.

About the Author: T.L. Headley is a veteran public relations expert and former journalist with more than 20 years in mass communications with a focus on energy. Headley has an MBA in finance and management and an MA in journalism. He is the principal for Genesis Communications and is a public relations consultant for several major coal and energy organizations in West Virginia. Headley is also a 2001 graduate of the West Virginia Chamber of Commerce’s Leadership West Virginia program.

By T.L. HEADLEY, MBA, MA

11,000….

That’s how many West Virginia coal miners have lost their jobs in the past seven years.

That’s 11,000 families whose lives were turned upside down by the policies of the Obama Administration and the National Democratic Party.

And each one of those 11,000 jobs supported another 5 jobs… that’s another 55,000 jobs and another 55,000 families.

When you stop to consider that most of these people were in the prime years of their lives, most had kids, mortgages, truck payments, they were saving for college, saving for retirement….

Their taxes paid for schools, for roads, for water and sewer lines. They paid for sheriff’s deputies and programs for senior citizens.

Today, those jobs are gone and so are the taxes…

This is the legacy of the Obama Administration, the national Democratic Party and the radicals who control the EPA. Over the next few months, we are going to be making a decision about who will lead our state and nation forward for the next eight years.

Hillary Clinton and Bernie Sanders would continue Obama’s anti-coal policies and, double down on them, costing even more coal jobs . We can’t afford that.

We aren’t telling you who to vote for…. but we can tell you who NOT to vote for if you care about our state and its future. A vote for Clinton or Sanders will destroy our state … it’s that simple….

Make your votes count … choose wisely.

CHARLESTON – West Virginia Coal Association

President Bill Raney today issued the following statement about recent comments by Democratic presidential candidates Hillary Clinton and Bernie Sanders.

There is no doubt that West Virginia is facing an economic and a fiscal crisis. We are reminded constantly of our troubled times. Miners being laid off because of President Obama’s War on Coal. A majority of our adults not working. High unemployment. Dead last in job growth because we are the most over-regulated state in the nation. A $353 million state budget deficit that is only going to grow in the short term because of the dramatic decline of severance taxes and the ripple effect it will have on income and sales taxes.

Now more than ever, we need a new direction. A new plan to move our state forward. We can no longer keep doing the same things and expecting different results. As a small businessman, I know what it takes to meet budgets, control costs, and above all, create jobs. These are the very principles I am applying in my duties as President of the West Virginia Senate.

Last year, the West Virginia Legislature took dramatic steps to pass comprehensive legal reforms that have already resulted in lower insurance rates. In all, we were able to get 10 bills passed and signed into law to help relieve the budgets of families and small businesses. In the first half of this year’s session, we have taken bold steps to jump start our economy by passing the West Virginia Workplace Freedom Act that sends a message loud and clear to the rest of the country that this state is a place open for new jobs.

We also reformed our labor laws by eliminating West Virginia’s prevailing wage rate. This protects taxpayers, increases capital for new construction and allows more local businesses to compete for public projects instead of protecting a rigged system for a select few. This will get more of our state’s workers back to work.

These efforts faced great opposition from special interest groups who simply want to protect the status quo. But, West Virginia must change if we are going to compete, get our economy growing, and create jobs. We must create a new plan that will enable us to grow.

The Senate also has taken steps to help our coal industry get back on its feet. We are working to make sure that a tax that is set to expire does so. And, we are working to repeal outdated regulations that are strangling businesses’ ability to grow and create jobs.

A new plan for our state must be rooted in development of the infrastructure of tomorrow. That’s why the Senate is acting to ensure every part of our state has access to high speed broadband by providing tax credits for broadband development in rural areas. We also will take up efforts to fund the middle mile across West Virginia. We must work quickly towards a goal of meeting the FCC’s 25 Mbps standard for every region of our state. The expansion of broadband is a jobs bill for both the short term to build it and the long term, as it will spur entrepreneurship and increase education opportunities for students.

Many people have said we are taking up too many tough issues that will be used against us politically. Each member of the Legislature got elected to do what they think is right. Despite some of the bitter disagreements recent actions have created, I firmly believe we need to advance

a new plan to move our state forward that creates jobs. There are only two types of jobs I care about – good jobs, and jobs right here in West Virginia.

Senate President Bill Cole, R-Mercer, represents the Sixth Senatorial District, which includes Wayne, Mingo, McDowell and Mercer counties.

CHARLESTON- The West Virginia Coal Association’s 43rd Annual Mining Symposium will kick off at 8:30 A.M., Wednesday, January 27 at the Charleston Civic Center.

CHARLESTON- The West Virginia Coal Association’s 43rd Annual Mining Symposium will kick off at 8:30 A.M., Wednesday, January 27 at the Charleston Civic Center.

Thursday morning will begin at 7:30 a.m. with a breakfast sponsored by Walker Machinery and Dinsmore & Shohl.

The usual full and informative program will begin at 8:30 a.m. with our congressional delegation, well known lawyers and scientists rounding out the program. The afternoon will feature a new WVCA member, the Virginia Conservation Legacy Fund. VCLF CEO Tom Clarke will discuss the organization and its vision and will be followed by coal industry leaders and members of Congress and the Legislature.

The Annual Reclamation Awards Luncheon will be sponsored by Babst Calland and Civil & Environmental Consultants, at noon.

By T.L. HEADLEY, MBA, MAT, MA

Energy Analyst

CHARLESTON – According to the latest reports from the Energy Information Agency (EIA), coal production in the U.S. finished 2015 off approximately 13 percent from 2014 totals. Meanwhile spot prices for coal continue their long term decline and natural gas slipped back slightly from recent highs.

According to the EIA’s January 2, 2016 weekly report, U.S. coal production for the year totaled 886.49 million tons, down from 995.47 million tons (down 11.1 percent). The trend appears to be steepening. According to the EIA’s January 22 report, production was only 13.32 million tons, off from 19.61 million tons for the same week a year ago (off 32 percent). This is mirrored in the week’s rail car loadings, which at only 75,308 car loads, off 32.7 percent from the 111,982 car loads. This decline in rail traffic is almost entirely due to the decline in coal production and has resulted in both major eastern rail systems announcing major restructurings. CSX last week announced it is closing its regional headquarters in Huntington, West Virginia. Norfolk Southern likewise announced it is closing the Bluefield, West Virginia offices.

Coal exports for the month of November (the most recent data available) were sharply below last year. Metallurgical coal exports are off by 39 percent from November 2014 and steam coal exports are off by 34 percent. Imports of coal into the U.S were down for the month by 12.1 percent. For the year ending December 31, metallurgical coal exports were down 24.7 percent and steam coal exports were down 21.8 percent compared to the same period last year. Imports of coal for the year were down 3.8 percent from 2014.

Electric output was down 3.9 percent compared to the same week last year, with 79,650 MWH of electricity produced compared to 68,519 MWH produced for the same period last year. Electric production for the year was off 3.9 percent, which can be attributed at least in part to the mild fall across most of the country.

Domestic steel output, however, was down from the previous week.

According to numbers from the American Iron and Steel Institute, in the week ending January 16, 2016, domestic raw steel production was 1,652,000 net tons while the capability utilization rate was 69.1 percent. Production was 1,807,000 net tons in the week ending January 16, 2015 while the capability utilization then was 76.4 percent. The current week production represents a 8.6 percent decrease from the same period in the previous year. Production for the week ending January 16, 2016 is up 3.6 percent from the previous week ending January 9, 2016 when production was 1,594,000 net tons and the rate of capability utilization was 66.7 percent.

Adjusted year-to-date production through January 16, 2016 was 4,686,000 net tons, at a capability utilization rate of 65.3 percent. That is down 13.4 percent from the 5,412,000 net tons during the same period last year, when the capability utilization rate was 76.4 percent.

In terms of regional coal production, all three major basins reported significant losses for the year.

The Appalachian Basin finished the year at 226.72 million tons, down from 267.70 million tons in 2014 (-15.3 percent). Interior Basin production also finished the year down at 167.92 million tons compared to 188.16 million tons last year (-10.8 percent). Western production finished the year at 491.85 million tons from 541.55 million tons last week (-9.2 percent). For the week ending January 16, production was also down in two of three basins. Appalachian Basin production finished the week at just 3.24 million tons, off from 3.31 million tons last week. The Interior Basin finished the week at 2.50 million tons, off from 2.53 million tons, and the Western Basin finished slightly up at 7.58 million tons from 7.56 million tons.

According to the West Virginia Office of Miners’ Health Safety and Training, coal production in the state now stands at 100.65 million tons through December 15th. Of that total, 82.19 million tons was mined by underground operations and 18.56 million tons was produced by surface mining. Only 58 mines have reported production in December2015. Several large operations have idled production due to financial restructuring or in response to slack demand.

However, according to WVOMHST, coal mining employment in West Virginia grew slightly to 15,774 total miners, with 12,705 working underground and 3,069 working on surface operations. The office does not report data for contract miners or preparation plant workers on a weekly basis. Final reports for 2015 are due by the end of January and will be reflected in February reports.

According to EIA, West Virginia coal production for the year totaled 97.81 million tons, off from 111.87 million tons. This is off 12.6 percent from 2014. EIA always reports lower production than state reports. Meanwhile, West Virginia production finished the week of 1.26 million tons, up slightly from 1.25 million tons the previous week, but off from 1.89 million tons last year.

Production was down in both the northern and southern coalfields of West Virginia compared to last year by 6.7 percent and 23.2 percent respectively. For the week, northern West Virginia production finished up at 644,000 tons versus 620,000 tons last week and 892,000 tons last year. Southern West Virginia, however, finished down at 618,000 tons versus 628,000 tons last week and 993,000 tons a year ago.

For this week, we will focus on annualized coal production for other states, picking up weekly totals with next week’s report.

Coal production in Kentucky ended the year at 63.20 million tons produced, down by 18.1 percent from the 77.19 million tons from 2014. Eastern Kentucky coal operations finished the year at 29.52 million tons, down by 21.1 percent to 37.39 million tons. Meanwhile, western Kentucky coal operations finished off by 15.4 percent, at 33.68 million tons versus 39.39 million tons in 2014.

Wyoming coal production finished the year at 369.10 million tons versus 394.78 million tons in 2014, off by 8.3 percent .

Illinois coal production finished 2015 at 59.81 million tons versus 57.96 million tons, up by 3.2 percent from 2014. Indiana production, however, fell significantly, finishing at 34.71 million tons versus 39.16 million tons the previous year. Ohio production finished 2015 off by 20.9 percent – at 17.55 million tons versus 22.19 million tons in 2014. Pennsylvania production was down by 16.3 percent year over year, finishing at 51.63 million tons in 2015 versus 61.66 million tons in 2014. Virginia coal production continued to fall in 2015, finishing the year down 14.5 percent — at 13.21 million tons versus 15.45 million tons in 2014.

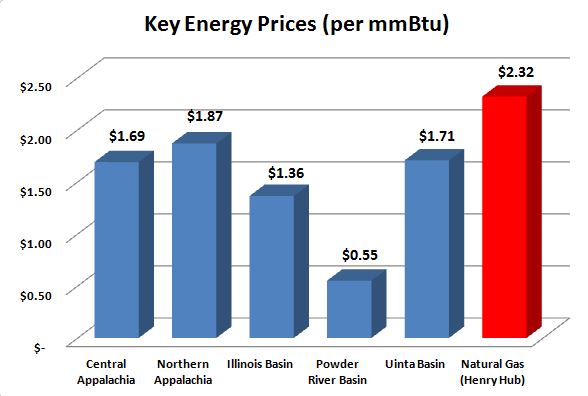

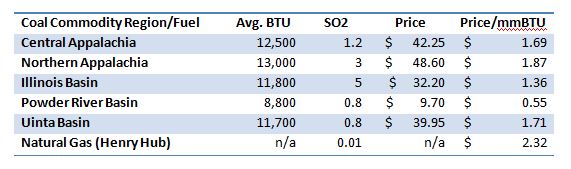

Coal prices on the spot market were all down this week, with all basins finishing down for the year. Central Appalachian coal finished the week at $42.25 per ton or $1.69 per mmBtu. Northern Appalachian coal also finished down, coming in at $48.60 per ton or $1.87 per mmBtu. Illinois Basin coal closed down at $32.20 per ton or $1.36 per mmBtu, while Powder River Basin coal fell to $9.70 per ton or $0.55 per mmBtu. Uinta Basin coal prices finished at $39.95 per ton or $1.71 per mmBtu.

Natural gas prices on the Henry Hub continued fell back slightly this week to finish at $2.32 per mmBtu from $2.38 per mmBtu last week and significantly off from $3.08 per mmBtu a year ago. Natural gas producers reported a significant decline in their stored reserves – down 168 billion cubic feet compared to the previous week, for a total of 3.48 trillion cubic feet in storage. This week’s working natural gas rotary rig count is down by 13 from last week to 637 working rigs. And the count remains down by 996 rigs from a year ago – a decline of 36%. This number includes rigs working in both oil and gas plays.

About the Author: T.L. Headley is a veteran public relations expert and former journalist with more than 20 years in mass communications with a focus on energy. Headley has an MBA in finance and management and an MA in journalism. He is the principal for Genesis Communications and is a public relations consultant for several major coal and energy organizations in West Virginia. Headley is also a 2001 graduate of the West Virginia Chamber of Commerce’s Leadership West Virginia program.

| CoalCommodity Region/Fuel | Avg. BTU | SO2 | Price | Price/mmBTU |

| Central Appalachia | 12,500 | 1.2 | $49.00 | $1.96 |

| Northern Appalachia | 13,000 | 3 | $52.00 | $2.00 |

| Illinois Basin | 11,800 | 5 | $32.75 | $1.39 |

| Powder River Basin | 8,800 | 0.8 | $11.55 | $0.66 |

| Uinta Basin | 11,700 | 0.8 | $40.55 | $1.73 |

| Natural Gas (Henry Hub) | n/a | 0.01 | n/a | $2.02 |

CHARLESTON – Coal production in the U.S. for the week ending November 7th fell slightly from the previous week, continuing to trend below 2014, according to the latest report from the Energy Information Agency (EIA).

Production in the United States was down by 158,000 tons (-1.0%) to finish the week at 16.47 million compared to last week’s total of 16.63 million tons. Meanwhile, production for the week is off by 2.87 million tons (15%) from the 19.35 million tons for the same week in 2014.

Cumulative production for the year-to-date remains sharply down as of November 7th, coming in at 775.60 million tons compared to 851.29 million tons last year – a decline of 75.68 million tons or 8.9%. Production for the previous 52 weeks also continues lower from last year– finishing at 921.85 million tons compared to 987.97 million tons for the same period ending in 2014 (-6.7%).

Meanwhile, the number of coal rail car loadings remains down from last year, finishing the week at 94,974 cars, off 1% from same week in 2014. Coal loadings also continued their decline year-to-date – off 9.6% from the same period in 2014.

Coal exports for the month of September continue sharply below last year. Metallurgical coal exports are off by 33.2% from September 2014 and steam coal exports are off by 27.4% Imports of coal into the U.S. is up by 21.3 percent. Year-to-date, metallurgical coal exports are down 21.5% and steam coal exports are down 22.6% compared to the same period last year. Imports of coal are up 6.1% for the period versus last year.

Electric output was down 1.8% compared to the same week in 2014, with 68.62 MWH of electricity produced compared to 69.89 MWH produced for the same period last year.

Domestic steel output, however, was down from the previous week.

According to numbers from the American Iron and Steel Institute, domestic raw steel production was down 1.4% from the previous week, coming in at 1.62 million tons compared to 1.64 million tons last week, with a capacity utilization factor of 67.7%. Steel production is down sharply from the same week last year, when 1.86 million tons were produced at a capacity utilization rate of 77.2%. Steel production continues its slide year-to-date – down 8.2% to 76.13 million tons produced compared to 82.94 million tons for the same period last year.

In terms of regional coal production, all three major basins reported modest losses for the week ending November 7th compared to the previous week, but all continue sharply lower compared to the same week in 2014.

The Appalachian Basin finished at 4.03 million tons, down from 4.04 million tons last week (-0.5%). Interior Basin production also finished down at 3.17 million tons compared to 3.24 million tons last week (-2.2%). Western production finished the week lower at 9.27 million tons from 9.36 million tons last week (-0.1%). However, production remains sharply below the same week in 2014. The Appalachian Basin is off by 17.1% from the same week last year. The Interior Basin is off 13.9% from 2014. And Western production is off 14.2% from the same period in 2014.

All three basins also continue to report significant declines in production year-to-date, with Appalachia down 13.6%, the Interior Basin off 8.6% and the Western Basin down 6.6%.

Looking at the previous 52 weeks, all three basins continue lower for the period ending November 7th, with the Appalachian Basin down 11.6%, the Interior Basin down 6.0% and the Western Region down 4.5%. Production in the Interior Basin fell to 174.43 million tons from 185.52 million tons for the same period in 2014. Appalachian production fell for the period to 236.49 million tons from 267.57 million tons. Meanwhile, Western production is down to 510.93 million tons from 581.73 million tons in 2014.

According to the West Virginia Office of Miners’ Health Safety and Training, coal production in the state now stands at 81.10 million tons through November 5th. Of that total, 65.39 million tons was mined by underground operations and 15.71 million tons was produced by surface mining. A total of 107 mines are now reporting production through September 2015.

According to WVOMHST, coal mining employment in West Virginia fell slightly to 14,848 total miners, with 12,052 working underground and 2,796 working on surface operations. The office does not report data for contract miners or preparation plant workers on a weekly basis.

According to EIA, West Virginia coal production for the week totaled 1.74 million tons essentially unchanged from the previous week (-1%). Meanwhile, West Virginia production is off by 13.9% from the same week in 2014.

Production was up in the northern coalfields but down in the southern coalfields of West Virginia compared to last week, by 0.4% and 0.2% respectively. However, production is off in both areas year-to-date, by 1.3% and 18.2% respectively.

Coal production in Kentucky for the week ending November 7th was also up slightly compared to the previous week but remains down from the same period in 2014. Kentucky production for the week was reported at 1.12 million tons, up from 1.11 million tons last week but down from the 1.39 million tons for the same week in 2014. Production in eastern Kentucky picked up slightly, while western production declined slightly. Year to date, production in Kentucky is off by 16.5%. Meanwhile production in the state is off by 41.7% for the previous 52 weeks, with western Kentucky reporting an 11.8% decline and eastern Kentucky operations reporting a decline of 17.8% year-over-year.

Wyoming coal production was down for the week, coming in at 6.87 million tons, compared to 6.94 million tons the previous week, but down from the 7.93 million tons produced for the same week in 2014 – a decline of 1.1%. For the previous 52 weeks, Wyoming production is down 9.0%.

Illinois production finished down, at 1.15 million tons compared to 1.20 million tons last week. Illinois production is up by 8.7% for the previous 52 weeks.

Indiana production came in at 638,000 compared to 642,000 tons for the same week in 2014. Indiana production is down by 7.2% over the previous 52 weeks. Pennsylvania production for the week was also down, to 941,000 tons versus 950,000 tons for the previous week, and production in the Keystone State is down sharply (-10.9%) for the previous 52 weeks.

Ohio production also ticked slightly higher – at 301,000 tons compared to 298,000 tons the previous week. Ohio coal production is off 19.6% year-to-date and down 17.8% for the previous 52 weeks, compared to the same period ending in 2014. Virginia production was unchanged this week – at 227,000 tons. Virginia production year-to-date is off by 12.6% and down for the previous 52 weeks by 12.6%.

Coal prices on the spot market were mixed this week. Central Appalachian coal rose slightly to finish the week at $1.96 per mmBtu. Northern Appalachian coal also finished slightly up, coming in at $52.00 per ton or $2.00 per mmBtu. Illinois Basin coal closed down at $32.75 per ton or $1.39 per mmBtu, while Powder River Basin coal held at $11.55 per ton or $0.66 per mmBtu. Uinta Basin coal prices finished at $40.55 per ton or $1.73 per mmBtu.

Meanwhile, on the NYMEX Coal Futures board, Central Appalachian coal is up to $42.02 per ton compared to $41.88 per ton to last week, while Western Rail rose slightly to $10.18 per short ton from $10.16 and Eastern Rail coal is up to $37.63 per short ton from $36.62 the previous week.

Natural gas prices on the Henry Hub continued to fall this week to finish the week at $2.02 per mmBtu. Natural gas producers again reported a significant increase in their stored reserves – up 52 billion cubic feet compared to the previous week, for a total of 3.93 trillion cubic feet in storage. This week’s working natural gas rotary rig count is down by 4 from last week to 771 working rigs. And the count remains down by 1,154 rigs from a year ago – a decline of 60%. This number includes rigs working in both oil and gas plays.